ABOUT TAX-FREE INVESTMENTS

Why is it important to have

HOW IT WORKS

No tax on investment returns

INVEST ONLINE

Get started with a Sanlam Tax-Free Savings Account

Please select a financial planner from our practice, or select “I do not have one”, to have one assigned to you. Your investment will be included in your comprehensive plan. For this commission of 2.5% of any recurring payments and 1% of any one-off payments will be payable. Should you add the ability to select your own funds, you will be provided with ongoing investment advice and services, including performance feedback, for which 0.575% of the fund value per year will be payable (including VAT, if applicable).

Please select a financial planner

Frequently asked questions

Some of your questions answered

How Tax-free Savings Accounts Work

Sanlam Tax-free Investments provide an easy and effective way to save for your long-term goals, without having to pay tax on interest, dividends or capital gains. Other distinguishing features include:

- The ability to withdraw money at any time

- Contribute up to a maximum of R36 000 per year

- A lifetime contribution limit of R500 000

Sanlam’s Tax-free Investment Offering

You can make monthly or one-off payments into a Sanlam Tax-free Investment. The payments in any tax year are limited to the annual contribution limit in that year. As of 1 March 2020, this is currently R36 000 per year. The total lifetime contribution limit is R500 000. If you go above these limits you will incur tax penalties.

- If you choose to make monthly payments, you can pay between R400 and R3 000 per month. If you choose to select your own funds, the minimum contribution is R500 per month.

- If you start with a one-off payment, you can pay between R15 000 and R36 000.

You can add additional one-off payments of between R3 000 and R36 000 in future, as long as your total payment in the tax year does not exceed the annual contribution limit. The maximums above will be adjusted if the annual contribution limit is changed.

Making Payments into a Tax-free Investment

Recurring payments into the Sanlam Tax-free Investment are payable by debit order.

One-off payments at the start of the plan are also payable by debit order.

You can add additional one-off payments during the lifetime of the plan on Sanlam Secure Services or by contacting the Sanlam Client Care Centre at 021 916 5000 or 0860 726 526 (SANLAM), or send an email to life@sanlam.co.za.

You can access Sanlam Secure Services via the Login button on www.sanlam.co.za.

Investment Options

If you select the default option, your money is invested in the Satrix Life Time Investment Option for Tax-free Investments. This option invests in the Satrix Balanced Index Fund and the Satrix Low Equity Balanced Index Fund. We manage the allocation to these funds on your behalf. If the investment term is longer than 10 years, all funds are initially invested in the Satrix Balanced Index Fund. This fund is moderately aggressive and can have a fair amount of fluctuations in short-term returns, in anticipation of higher real return over the long-term. If the remaining expected investment term is less than 10 years, the funds are gradually switched to the Satrix Low Equity Balanced Index Fund, a fund with more stable investment returns. Both of these funds are passively managed funds, tracking a basket of indices.

If you prefer to select your own funds, we offer a range of quality investment funds. You can choose up to five funds at first, and can switch between these funds at any time. The first four switches in any plan year are free. You can get more information on the available funds in their fund fact sheets.

Account Information

After the start date of your plan, you can get information on Sanlam Secure Services. You can register using your plan number by going to the Secure Services link under Login on www.sanlam.co.za. Alternatively, you can contact the Sanlam Client Care Centre at 021 916 5000 or 0860 SANLAM (0860 726 526), or send an email to life@sanlam.co.za.

Withdrawals and Submitting a Claim

You can withdraw money at any time. No fees will be charged for withdrawals.

Any re-investment will count towards your total tax-free savings payments, which are limited to R500 000 over your lifetime. Withdrawing funds may prevent you from reaching your savings goals.

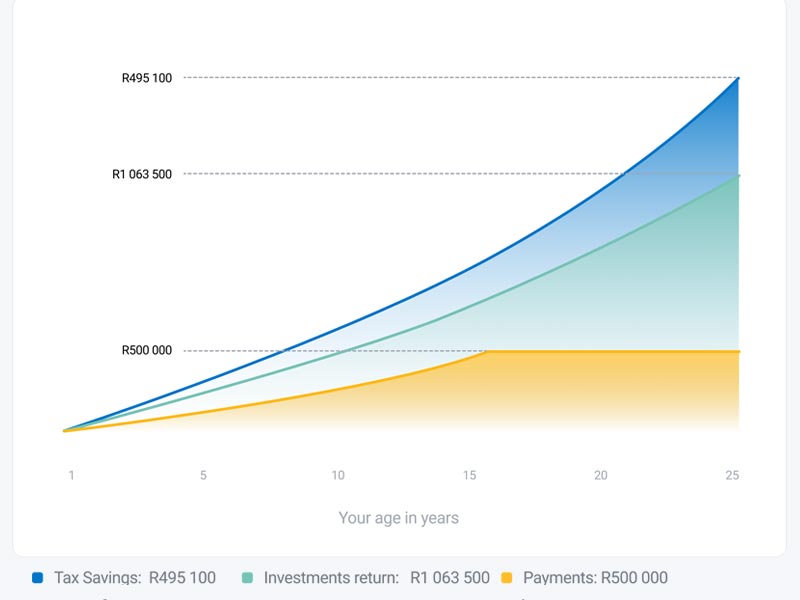

The effect of compound interest, or earning investment return on investment return, is increased in a tax-free savings account due to the tax relief on the investment return. The longer you invest the more benefit you will get.

In the event of a claim, please tell us as soon as possible. To get the necessary claim forms and to make sure that all the required information is supplied, contact the Sanlam Life Claims Call Centre at 021 916 1710.

Depending on the nature of the claim, certain documents (e.g. a death certificate) may be required.

Get expert financial advice

Speak to us now and get advice from an accredited financial planner.