ABOUT GAP COVER

What it is - and why it matters

HOW IT WORKS

Gap cover explained

2023 BENEFITS

Sanlam Comprehensive Gap Cover Plan

In-hospital Benefits

The difference between the specialist’s fee and the medical scheme tariff.

Additional 5-times medical aid tariff

A sub-limit is a limit when a medical scheme imposes a Rand limit, known as a sub-limit, on certain in-hospital medical procedures or prosthetic devices and a shortfall occurs.

R60,900 per event/condition

The excess payable upfront to the hospital before treatment or a procedure.

Subject to the Core Benefit Limit

A deductible is a co-payment payable by a member on admission to hospital.

Subject to the Core Benefit Limit

A maximum of two such events are covered under this benefit per annum and up to a maximum amount of R17,500 per event, subject to the Core Benefit Limit.

Out-of-hospital benefits

MRI Scans: A CT scan is best suited for viewing bone injuries, diagnosing lung and chest problems, and detecting cancers. An MRI is suited for examining soft tissue in ligament and tendon injuries, spinal cord injuries, and tumours. CT scans are widely used in emergency rooms because the scan takes less than five minutes. An MRI, on the other hand, can take up to 30 minutes.

Oncology: Oncology is a branch of medicine that deals with cancers and tumours.

MRI/CT scans: Unlimited

Oncology sub-limits: Limited to statutory maximum of R195 498 per insured per annum

The Casualty Benefit will pay for the facility fee and consultation associated with admissions into the emergency room or casualty ward of a private hospital.

Subject to a maximum of R17,400 per event

Child Casualty Benefit

Benefits relating to this clause will only be paid in respect of emergency out-patient services that are provided within a casualty ward of a hospital. The benefit is only payable in the event of after-hours treatment in an emergency situation. After-hours is Mondays to Fridays between 18:00 and 08:00 and all-day Saturdays, Sundays and South African public holidays. The benefit payable is equal to the total cost of treatment less the amount paid by your medical scheme from your hospital/risk benefit. If payment is made from your available medical savings account, or from your own pocket, we will reimburse that too.

Subject to a maximum of two such events per annum and a maximum of R2,700 per event. Limited to children under age 12

Additional Benefits

A cash payment you receive for every day you spend in hospital due to an accident or premature birth (more than 41 days before the originally expected natural birth date of 40 weeks).

If you’re a Sanlam Reality member, please refer to the Sanlam Reality section for more information on your Hospital Cash Benefit.

A maximum of two hospital episodes are covered under this benefit per annum, up to a maximum amount of R29,300 per annum. The benefit is payable from day one of the hospital episode: R480 per day from the 1st to the 13th day (inclusive). R860 per day from the 14th to the 20th day (inclusive). R1,700 per day from the 21st to the 30th day (inclusive). Max R29,300 per annum.

The natural or surgically assisted birth of 1 or more infants that occurs more than 41 days before the originally expected natural birth date of 40 weeks as verified by the clinical records of the mothers attending physician.

Lump sum benefit is R15 900.

The lump sum benefit is payable upon the death or permanent disability of an insured party due to accidental harm.

Limited as follows:

Children below 6 years: R20 000

All other insured parties: R30 000

The benefit payable is equal to the monthly medical scheme and Gap contribution applicable after the qualifying event, multiply by 6 and subject to an overall annual limit. This benefit is limited to one event over the policy lifetime.

The benefit payable is subject to an overall maximum limit of R35 500.

The lump sum Benefit will only be paid in the event of Dental Reconstruction Surgery being required as a direct result of Accidental Harm or from Oncology Treatment that occurred after the Inception of this Policy.

A maximum of two such events are covered under this benefit per annum and up to a maximum amount of R49 900 per annum subject to the Core Benefit Limit.

An end-to-end legal service is provided by the nominated service provider of Kaelo Risk to assist Insured members with legitimate claims against the Road Accident Fund.

Seamless claims process

Medical event occurs

Medical event occurs

Medical provider submits claims to medical scheme for payment

Medical scheme assesses claims and identifies shortfalls

Member receives statement noting payment shortfalls, requiring payment

Member receives statement noting payment shortfalls, requiring payment

Once all documentation is received, claims shortfalls are paid within 7 to 14 working days

Claims shortfalls are paid within 7 to 14 working days

Member is paid and send a statement as confirmation

Member is paid and send a statement as confirmation

Mediclinic Extender

Out-of-hospital benefits

Additional benefits

Seamless claims process

Mediclinic Extender

Benefits

Casualty illness

Benefits relating to this clause will only be paid in respect of Emergency outpatient services that are provided within a casualty ward of a hospital. The Benefit is only payable in the event of after-hours Treatment in an Emergency situation.

After-hour emergency illness only at a Mediclinic for all Insured Parties covered (Mondays to Fridays: 6pm – 8am. All-day Saturdays, Sundays & public holidays).

Subject to a maximum of two such events per Annum and a maximum of R2 500 per Insured Event.

Specialist Benefit - Out-of-hospital.

This Benefit will become payable when your Medical Scheme has paid a portion of your out of hospital specialist claim. We will cover the shortfall thereof.

Up to R4 900 per Insured Party per Annum, subject to the Overall Annual Limit.

Cover for the difference between the cost of a general ward and a private ward. Payable only in the event of confinement (childbirth) admissions. Only at a Mediclinic hospital (if available).

Subject to a maximum of one event per Insured Party per Annum and a maximum of R4 900 subject to the Overall Annual Limit.

The benefit payable is equal to the monthly medical scheme and gap contribution applicable after the qualifying event, multiply by six and subject to an overall annual limit. This benefit is limited to one event over the policy lifetime.

Benefit is limited to one claim per Insured Party and is only payable on first-time diagnosis as a lump sum of R10 000.

Benefits relating to this clause will only be paid in respect of defined diagnostic procedures that occurred during an

Insured Event.

The Benefit payable is equal to the fixed value Deductible or Co-payment amount, as defined in the rules of the Insured Party's Medical Scheme.

Benefit is directly payable to the Mediclinic Pre-authorisation letter required.

Unlimited subject to the Overall Annual Limit.

Only at a Mediclinic facility.

Notwithstanding exclusion related penalties, the Insurer will pay a fixed value Penalty Co-payment or Deductible, or a percentage Penalty Co-payment that does not exceed 30%, for the voluntary use by an Insured Party of a Mediclinic facility that is not part of their Medical Scheme Hospital Network.

Unlimited only at a Mediclinic facility subject to a maximum of R16 500 per event and subject to the Overall Annual Limit.

Frequently asked questions

Some of your questions answered

Why do I need gap cover?

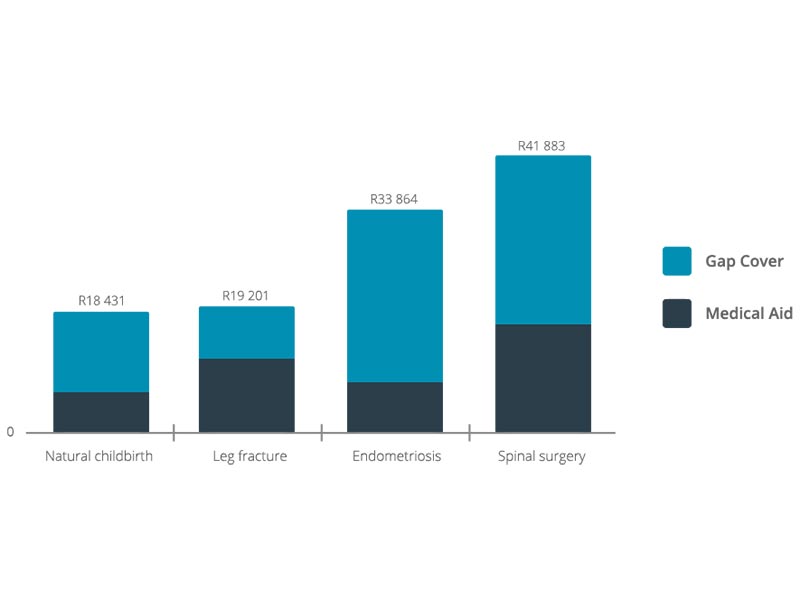

In certain cases the cost for in-hospital procedures or outpatient treatment may exceed the base medical aid rate by 5-times. By taking out Sanlam Medical Gap Cover Insurance, you ensure that you and your family aren’t left with a large excess amount to settle.

Do I qualify for gap cover?

- You need to be an existing member of a registered medical aid scheme.

- Gap cover extends to the principal member, their spouse and children up to age 27. Families covered on 2 medical aids will be covered by a single Sanlam Gap Cover policy.

- Special dependents may be included (excluding financially dependent parents).

Are there any waiting periods?

Yes, the following waiting periods apply:

- A general waiting period of 3 months on all benefits.

- A 12 months condition specific for pre-existing conditions for which you received advice, treatment or diagnosis during the 12 months prior to the cover commencing.

- Please refer to our Policy Document for 2023 (Section H) for more information.

What treatments are not paid for by gap cover?

- Treatment for obesity, including bariatric surgery (stomach stapling).

- Treatment for cosmetic surgery unless necessitated by a trauma or as a result of oncology treatment (e.g. breast reconstruction following a mastectomy).

- Specialised Dentistry is only paid for on the Sanlam Gap Cover Comprehensive Plan in the event of trauma, cancers and tumours.

- Claims older than 6 months.

- Any claim that is excluded or rejected by the Insured’s medical scheme.

- Please refer to our Policy Document for 2023 (Section I) for more information.

How much does gap cover cost?

Comprehensive Medical Gap Cover

- Individuals

0-59 years R262pm

60+ years R494pm - Families

0-59 years R459pm

60+ years R864pm

How do I claim?

Claims are assessed by Kaelo Risk (Pty) Ltd, the Sanlam Gap Cover administrator. Claims must be submitted within 6 months of an event.

Claim submissions can be sent to:

Email: sanlamclaims@kaelo.co.za

Fax: 086 501 8521

Or contact Kaelo Risk at: 0861 11 11 67

We require the following documents from you to process your claim:

- Claims transaction remittance (receipt) from the medical scheme.

- Relevant doctors’ accounts.

- Hospital account (the first four pages showing admission/discharge times and ICD codes).

- Current medical scheme membership certificate (copy of the membership card is not accepted).

An e-mail and SMS is sent to the member when:

- The claim is captured.

- Outstanding documentation is requested (assuming you have not signed the authority form).

- The claim is authorised.

Please note that payments will be made directly into the principal member’s bank account.

More of your questions answered

1. Can my family (principal member, spouse and child/children) be on more than one medical aid scheme under one Sanlam Gap policy?

Yes

2. Will my parents that are dependants on my medical scheme have cover under my Sanlam Gap Cover policy ?

Financially dependent parents will be required to take out their own gap policy as Sanlam Gap will only cover the principal member, partner/spouse and children (under the age of 27).

3. Are supplementary benefits paid from the statutory limit of R195 498?

No, the supplementary benefits are additional benefits Sanlam offers their clients.

4. How long do I have to submit my gap cover claim?

Six months from the insured event.

5. Family Protector Benefit: Who is eligible to claim for this benefit?

All the beneficiaries covered on the policy can claim for this benefit in the event of death or permanent disability due to accidental harm. Children below six years R20,000, all other insured parties R30,000.

6. If a member was on a lower gap offering (for longer than 12 months) and joined Sanlam Gap Comprehensive, would Sanlam Gap impose waiting periods on their new enhanced/richer benefits?

No

7. Does Sanlam Gap have a list of conditions that are excluded for the first 12 months of cover?

No, only pre-existing conditions will be excluded for 12 months if the client did not have previous cover.

8. Will Sanlam Gap cover planned PMB (Prescribed Minimum Benefits)?

Yes, within the rules of your policy document.

9. How long do I have to register my newborn baby?

You have 90 days of which to add your baby onto your policy.

10. The penalty co-payment for the use on a non-network hospital is subject to a maximum of one event per family per annum and a maximum of?

A maximum of two such events are covered under this benefit per annum and up to a maximum amount of R17,500 per event, subject to the Core Benefit Limit.

Apply Online

Get Gap Cover now

Please select a financial planner from our practice, or select “none”, to have one assigned to you. This planner will be responsible for providing you with ongoing advice and receive any applicable commission or fees payable on your plans.

Please select a financial planner

New regulations

Limit on Gap Cover insurance benefits

Get expert financial advice

Speak to us now and get advice from an accredited financial planner.